SPECIAL: How Will War With Syria Affect Oil Prices?

As Syria’s civil war escalates, we see the situation get closer and closer to a larger military campaign with foreign intervention. So aside from the civilian catastrophe, how will this affect world crude oil prices?

In recent days, a Syrian fighter pilot defected to Jordan along with his MiG-21 fighter jet, even more atrocities committed by the Syrian Armed Forces as heavy artillery and the Air Force pound Homs dramatically raising the civilian death toll while the Free Syrian Army rebels retaliate with increasingly terrorist-like tactics, and rumors of high-ranking ruling Baath Party defections being negotiated behind the scenes.

With a Turkish fighter jet shot down over northern Syrian airspace by the Syrian Air Defense Forces, the prospects of foreign intervention and a larger military campaign are ever closer. Any action will surely be modeled on the recent UN “No-Fly Zone” established in Libya in support of the National Transitional Government which ultimately led to the collapse of the Gaddafi regime. As the days pass, the future of the Assad regime and the Syrian Baath Party as a whole seems more and more bleak.

In the first half of 2011, we saw dramatic price movements in all the commodities markets, especially crude oil. Prices peaked in April and May 2011 as WTI (West Texas Intermediate) crude oil reached over $114 and Brent oil exceeded $126 as the Arab Spring uprising was shaking up the Middle East and long-standing autocratic dictators were being overthrown by civilian movements.

These price movements expressed great volatility in the financial markets. However this volatility was largely due to risk pricing. Even as the war in Libya increased and oil production and exports where shut down, the world supply levels did not fall. This is because many major oil producers such as Saudi Arabia are not operating at full capacity, so it is very easy for them to make up any shortfall. So oil prices spiked to ever greater highs mostly due to risks in the market and uncertainty that the Arab Spring would spread to more important oil producers such as Saudi Arabia, Iran, or throughout the Emirates. Any disruption to the major production centers would have a catastrophic impact on crude oil exports and other nations would have trouble scaling up production to stabilize supplies and prices.

So what would happen to crude oil prices in the event of a UN-backed military campaign in Syria?

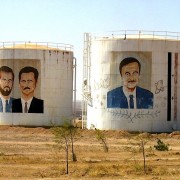

Syria is not a major oil producer, even though it is an important domestic resource and its finances are important to the Syrian Assad regime. They produce about 400,000 barrels per day – 0.5% of the global total and roughly the same amount as the US state of North Dakota. So any disruption to their complete production is relatively insignificant.

However any military action against Syria to oust the Assad regime for their civil war and brutalizing their own population will have significant political risks for many countries in the Middle East. Syria is often considered a puppet-state to Iran, so any action against Syria will put Iran on the defensive. Iran may strike back at Saudi Arabia, Kuwait, Iraq, Bahrain or the Emirates for their perceived support of military action against Syria. These are all Sunni Muslim-ruled nations with large oil reserves, while Iran is mostly Shiite Muslims. This Iranian retaliation will undoubtedly include attacks on these nations’ oil fields, and production and distribution centers – trying to hurt them in a powerful financial way.

The risk of any conflict with Syria spilling over into larger Sunni-Shiite war which will greatly hurt global crude oil production. This will cause a very large spike in the price of oil. However even the possibility of this – no matter how remote – will still cause the price of crude oil to rise.

Our Conclusions:

→ Precision airstrikes against the Assad regime will cause oil prices in the range of $100 to $105 per barrel.

→ A campaign in support of the Free Syrian Army like we saw in Libya will cause oil prices of about $110 per barrel.

→ Should the situation escalate and we see Iran openly involved and striking back at their Sunni neighbors, oil prices could easily be in the range of $120 to $150, and direct attacks on Saudi oil production could push oil to the range of $150 to $200 per barrel.

This volatility is what traders profit from. Open a free $100,000 demo practice account today with Ava FX, one of our Recommended GoldOilSilver Brokers.